Archive for the ‘interest rates’ Category

June 19, 2009

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

- Rates pulled daily around 10:00 a.m. from Bank of America’s website at http://www.bankofamerica.com/loansandhomes/index.cfm?template=findrate.Sales

- Price = $100,000

- Loan to Value = $80,000 (80%)

- State of Michigan

- Single family detached home

- Owner-occupied primary residence

- 30-year fixed-rate mortgage

- Rates above exclude points and mortgage insurance. Consult your mortgage representative for more information.

- These rates are not guaranteed until lock-in.

- Rates and terms are subject to change without notice. Interest rates assume credit history in good standing.

- All loan applications subject to credit and property approval. Flood and/or property hazard insurance may be required. Additional fees and closing costs may apply.

- Maximum loan limits and minimum equity/down payment requirements apply.

- Other restrictions may apply.

- Additional rates and programs are available.

- Assumes no other loans or liens.

- Assumes lock period based on current market conditions.

- Assumes taxes and insurance will be escrowed.

- Assumes applicant is a United States citizen.

- Fees are based on default county for each state. Fees are subject to change based on property county.

Posted in interest rates | Leave a Comment »

June 15, 2009

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

- Rates pulled daily around 10:00 a.m. from Bank of America’s website at http://www.bankofamerica.com/loansandhomes/index.cfm?template=findrate.Sales

- Price = $100,000

- Loan to Value = $80,000 (80%)

- State of Michigan

- Single family detached home

- Owner-occupied primary residence

- 30-year fixed-rate mortgage

- Rates above exclude points and mortgage insurance. Consult your mortgage representative for more information.

- These rates are not guaranteed until lock-in.

- Rates and terms are subject to change without notice. Interest rates assume credit history in good standing.

- All loan applications subject to credit and property approval. Flood and/or property hazard insurance may be required. Additional fees and closing costs may apply.

- Maximum loan limits and minimum equity/down payment requirements apply.

- Other restrictions may apply.

- Additional rates and programs are available.

- Assumes no other loans or liens.

- Assumes lock period based on current market conditions.

- Assumes taxes and insurance will be escrowed.

- Assumes applicant is a United States citizen.

- Fees are based on default county for each state. Fees are subject to change based on property county.

Posted in interest rates | Leave a Comment »

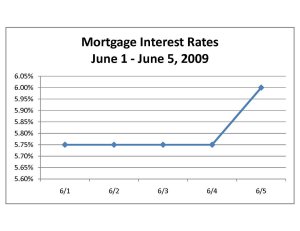

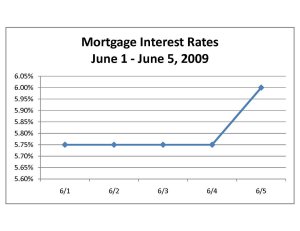

June 5, 2009

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

- Rates pulled daily around 10:00 a.m. from Bank of America’s website at http://www.bankofamerica.com/loansandhomes/index.cfm?template=findrate.Sales

- Price = $100,000

- Loan to Value = $80,000 (80%)

- State of Michigan

- Single family detached home

- Owner-occupied primary residence

- 30-year fixed-rate mortgage

- Rates above exclude points and mortgage insurance. Consult your mortgage representative for more information.

- These rates are not guaranteed until lock-in.

- Rates and terms are subject to change without notice. Interest rates assume credit history in good standing.

- All loan applications subject to credit and property approval. Flood and/or property hazard insurance may be required. Additional fees and closing costs may apply.

- Maximum loan limits and minimum equity/down payment requirements apply.

- Other restrictions may apply.

- Additional rates and programs are available.

- Assumes no other loans or liens.

- Assumes lock period based on current market conditions.

- Assumes taxes and insurance will be escrowed.

- Assumes applicant is a United States citizen.

- Fees are based on default county for each state. Fees are subject to change based on property county.

Posted in interest rates | Leave a Comment »

May 29, 2009

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

- Rates pulled daily around 10:00 a.m. from Bank of America’s website at http://www.bankofamerica.com/loansandhomes/index.cfm?template=findrate.Sales

- Price = $100,000

- Loan to Value = $80,000 (80%)

- State of Michigan

- Single family detached home

- Owner-occupied primary residence

- 30-year fixed-rate mortgage

- Rates above exclude points and mortgage insurance. Consult your mortgage representative for more information.

- These rates are not guaranteed until lock-in.

- Rates and terms are subject to change without notice. Interest rates assume credit history in good standing.

- All loan applications subject to credit and property approval. Flood and/or property hazard insurance may be required. Additional fees and closing costs may apply.

- Maximum loan limits and minimum equity/down payment requirements apply.

- Other restrictions may apply.

- Additional rates and programs are available.

- Assumes no other loans or liens.

- Assumes lock period based on current market conditions.

- Assumes taxes and insurance will be escrowed.

- Assumes applicant is a United States citizen.

- Fees are based on default county for each state. Fees are subject to change based on property county.

Posted in interest rates | Leave a Comment »

May 22, 2009

Above rates are provided to give you an idea of what rate activity has been in the last week. This will be a regular feature on Fridays. The following assumptions and fine print are included for protection:

- Rates pulled daily around 10:00 a.m. from Bank of America’s website at http://www.bankofamerica.com/loansandhomes/index.cfm?template=findrate.Sales

- Price = $100,000

- Loan to Value = $80,000 (80%)

- State of Michigan

- Single family detached home

- Owner-occupied primary residence

- 30-year fixed-rate mortgage

- Rates above exclude points and mortgage insurance. Consult your mortgage representative for more information.

- These rates are not guaranteed until lock-in.

- Rates and terms are subject to change without notice. Interest rates assume credit history in good standing.

- All loan applications subject to credit and property approval. Flood and/or property hazard insurance may be required. Additional fees and closing costs may apply.

- Maximum loan limits and minimum equity/down payment requirements apply.

- Other restrictions may apply.

- Additional rates and programs are available.

- Assumes no other loans or liens.

- Assumes lock period based on current market conditions.

- Assumes taxes and insurance will be escrowed.

- Assumes applicant is a United States citizen.

- Fees are based on default county for each state. Fees are subject to change based on property county.

Posted in interest rates | Leave a Comment »