![]()

Archive for the ‘Bank-owned’ Category

How to Buy a Bank-Owned Home

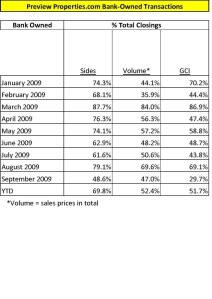

October 21, 2009Bank owned sales dropped in September at Preview Properties.com

October 8, 2009Huge Price Reduction on Fowlerville Home

April 8, 2009

9877 Crofoot in Fowlerville – was $97,000 now priced at $73,900. Bank authorized this 23.8% price reduction.

Full disclosure: it needs a kitchen.

3 bedroom, 2.1 bath home. 1,800 square foot, open floor plan with master suite. Great property for first-time homebuyer or investor. May qualify for FHA 203K program.

Seller will pay $1000 bonus to selling real estate agent if under contract by 4/30/09. Contact Andy Karas at 810-220-1416 or andy@teamkaras.com for more information.

Odds & Ends

March 15, 2009A Livingston County Press & Daily Argus headline on Sunday was “Home sales are up as value falls”. They reported the median sales price of a home in Livingston County was $132,000 in February, down more than 23 percent from the same time in 2008, according to Realcomp. There were 2,772 houses and condos on the market as of Feb. 28, compared to 2,882 the same time in 2008, according to the Livingston County Association of Realtors. Link to the article here: http://tinyurl.com/bfmhqf.

The New York Times ran the story “Thoughts on Walking Away From Your Home Loan” over the weekend. You can find the story, and interesting comments by the readers (over 100 on Sunday morning) at http://tinyurl.com/acrxan.

This Oakland County Press article gives some tips on avoiding foreclosure – http://tinyurl.com/bw6ksh. Article mentions foreclosure prevention counseling available from the Oakland Livingston Human Service Agency at (248)209-2692.

Have difficulties writing ads (print or web)? I found this service on the web http://www.writemyads.com/pub_why_it_works.go. Annual price is listed at $120/agent if you are interested.

Housing Rescue Plan

March 5, 2009Here are a few links to housing rescue plan info:

To read USA Today’s summary on the housing rescue plan – http://www.usatoday.com/money/economy/housing/2009-03-04-housing-rescue-plan_N.htm

To read USA Today’s posting “Who can qualify for housing help? follow http://www.usatoday.com/money/economy/housing/2009-03-04-housing-questions-answers_N.htm

A real estate technology blogger’s (Nicole Nicolay) take http://blog.roost.com/2009/03/04/fed-stay-home/.

Investing in Foreclosures Seminar – Brighton Office

February 6, 2009Seating is limited. If interested, please RSVP to Lisa Bohlen at 810-220-1505 or e-mail lbohlen@previewproperties.com by Tuesday, February 17.

1/16/09 – News of the Day

January 15, 2009Busy day today – registration for continuing education will take place at 8:30 a.m. Be sure to bring your $35 check and your pocket card. The training session will start at 9:00 a.m. then we’ll break for lunch – chili / two different ways is on the menu.

The annual sales banquet will start around 6:00 p.m. at Barton Hills Country Club. We’ll have cocktails starting at 6:00, followed by dinner, the award ceremony, then to wrap up the evening we will have a disc jockey with karaoke capabilities:)

Julie Fischer made a few suggestions in Thursday’s prospecting meeting you should take notice of:

- If you are representing a buyer on a bank-owned property, you need to flip your mindset.

- Larger earnest money checks may give your buyer an advantage if you are in a multiple offer situation.

- Financing preapprovals should look as good as possible. If the buyer has the capability to go above the listing price of the property in question, it is OK if that shows on the preapproval. If the home has multiple offers, and yours is the only buyer preapproved for more, it may be advantageous.

- Financing preapproved by a major lender looks more attractive than a local mom & pop brokerage.

The community service planning group met on Thursday. Based on our discussions, the “future events” section has been updated for dates of CITOs, blood drives and other events scheduled through June.

12/01/08 – News of the Day

December 1, 2008Top 10 Sales Producers for October at Preview Properties.com – I posted the video from this announcement on Saturday – you can find on this blog below.

http://www.homesteps.com/ – Attention all Preview Properties.com agents – I know some of you are already signed up as a HomeSteps Selling Agent Select Program, so thank you! For those of you who aren’t, I suggest you do so. This is a Freddie Mac unit committed to working with Real Estate Professionals to accomplish their goal of providing decent, accessible housing to all Americans. After you are enrolled, each Thursday you will receive a listing of current HomeSteps homes available for sale and those coming available – a nice feature – soon in your targeted zip codes (they allow you to have 10 targeted zip codes). This tailored list will be e-mailed each Thursday to the e-mail address you provide them. Property lists are only e-mailed to you when homes are available or coming available for sale in your selling areas. In addition, when a home buyer is shopping on their site for a home, they may now also shop for a selling agent in his or her area – hopefully that will be you! And another benefit: the more Selling Agent Selects Preview Properties.com has on the program, the higher our chance to get some of these listings – to distribute to you!

L.J. Jennings Visits Preview Properties.com

November 4, 2008- Team up with agents inside or outside of your office.

- Don’t put the lockbox on the home too quickly prior to listing. Then the appraiser will contact you and you can share info on how you arrived at BPO price.

- Submit your BPOs 2 days before deadline. You have to be better than the competition. Exceed asset manager’s wildest expectations, allowing them to get the home on the market quicker.

- Asset managers have two primary goals – to the get property sold for the most money in the least amount of time.

- Send an e-mail to the asset manager when you get the listing to ask who the closing agent is, allowing you to review title issues ASAP.

- Take city code enforcement to lunch.

- Carry an emergency kit in your vehicle when visiting your REO listings. The kit should include batteries, light bulbs, broom/dustpan, plunger, ladder, trashbags, gloves.

- Knock on neighborhood doors after acquiring listing. Give neighbors your card and ask that they contact you if they notice anything is not right with the property. Add these people to your prospect list.

- Send text messages to your prospects.

- 5 Foot rule – contacts enter L.J.’s database.

- If you receive floor calls on a property that is unavailable, don’t tell the caller it is unavailable. Create a buyer out of them. Always have a “B” plan.

- Call your asset managers once a month to touch base with them, suggested between 3rd and 7th of month. E-mail once a month too.

- Asset managers distribute listings based on how many people on your team. So make sure that number is accurate. If you increase the people on your team, be sure to notify the asset manager and ask for more business.

- Revitalize communities – an objective of Fannie Mae and Freddie Mac – make sure you communicate your interest in this to asset managers.

- You are a property manager for free.

- Join national organizations: NAREB, NAHREP, AREAA, NAR.

- Know the local eviction ordinances.

- Register your investment buyers as a bulk sale buyer with mortgage companies to get hot sheets.

- Host a community event to “know your note” – familiarize homeowners with their mortgage notes. Invite mayor, congressional members. Partner with non-profit organization.

- Establish referral program with schools, churches or non-profits. Donate $$ for every referral received as a result of program. Help build a library or a computer lab or —.

- Best comps are within 1 mile, within 10 years of age, within 80 to 120% of square footage of subject property.

- You are in the property disposition business.

11/03/08 – Monday – News of the Day

November 3, 2008Come into the office on Tuesday for a full day of events.

Before 9:00 a.m. – Breakfast served by first floor staff, with donations going toward our LACASA holiday family.

9:00 a.m. – 3:00 p.m. – L.J. Jennings, a REO expert from Oakland, CA, will share his knowledge with us. Come prepared to learn and be challenged. L.J. Jennings is a partner in Jetstream Mortgage, a real estate finance company. As a 19 year veteran of the real estate industry, L.J. prides himself on giving back to the community. He is currently Region 6 Chair of the California Association of REALTORS, President of the Sales Division for the National Association of Real Estate Brokers, Past Chairman of the Board for the California Association of Real Estate Brokers, a two term past President of the Oakland Association of Realtors, Past President and current Executive Vice President of the Associated Real Property Brokers, Chairman of the Board for the Bay Area Black United Fund, Vice Chairman and Treasurer for East Oakland Community Development Corporation, Charter member and Recording Partner for The Black Business Investment Group, Past President of Letip Oakland and a learned Sunday School teacher. As a hard working professional he has earned the respect of his peers and many community leaders, several times over, garnering him the award for best Mortgage Broker from the Valley to the Bay. Additionally, L.J. is an accomplished speaker, teacher and presenter, frequently sharing his insight and knowledge with audiences across the United States. He attended California State University Hayward, where he majored in Political Science and Business Administration. He is a graduate of the Dale Carnegie Courses. A life long resident of Oakland, he is married to Karen Jennings and together they have three lovely daughters, Jasmin 19, Lauren 16 and Lena age 8.